The Tax Reform Act of 1969 created private foundations and imposed greater restrictions on this classification including excise taxes and lower donor deductions for contributions. This Act created supporting organizations as an exception to private foundationsbecause they are organized operated and controlled in the public interest.

Solved Question 7 1 Pts The Graph Below Represents Supply Chegg Com

The FCAI reiterates that a road user charge is not an additional tax on motorists.

. It includes ordinary tax rates and capital gains tax rates. Federal tax deposits made by electronic funds transfer. Individual Income Tax Returns 2017 Individual Income Tax Rates 2017 28 2 Marginal tax rate as cited in this article is the highest statutory rate on taxable income.

Instead it can replace registration charges fuel excise license fees and luxury car taxes presenting an opportunity to reduce large bureaucracies required to administer these taxes that the body describes as inefficient. This concept does not include the effects of AMT. Generally you must use electronic funds transfer to make federal tax deposits such as deposits of employment tax excise tax for exceptions see Payment of Taxes later and corporate income taxGenerally electronic funds transfers are made using the Electronic Federal Tax Payment System EFTPS.

Microeconomics Lecture 7 Flashcards Quizlet

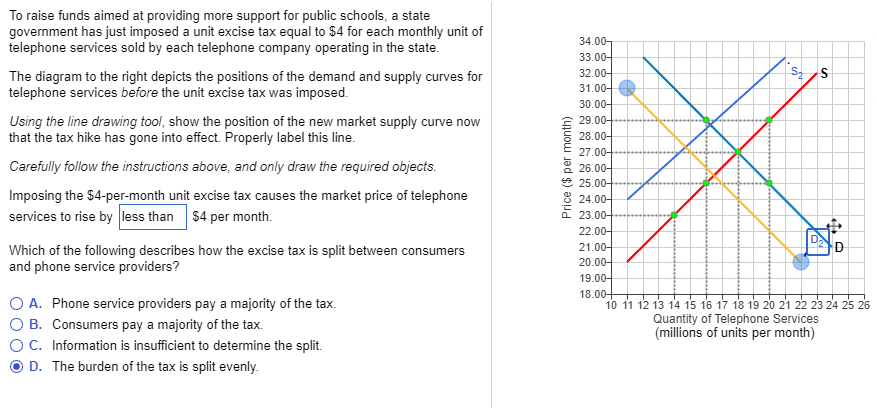

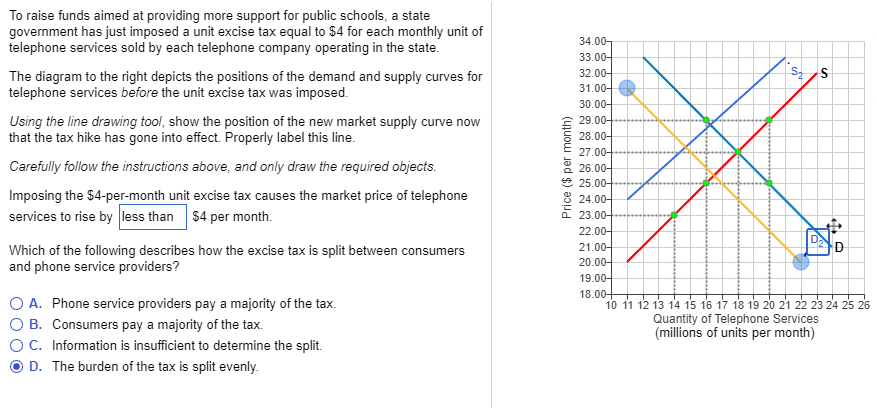

Solved To Raise Funds Aimed At Providing More Support For Chegg Com

Solved Please Help I Rate And Show Me How To Do The Graph Chegg Com

0 Comments